This is a good book digging into four of the most important companies ever (Amazon, Apple, Facebook, Google).

There is a huge amount of useful data here and the book reads in an easy style. Scott is controversial in good amounts, although he has a clear side of the argument which comes through in his writing (anti-Four). Acts as a good call-to-arms to view these companies with greater scrutiny given their influence.

Rating - 7/10.

View on Amazon here: The Four: The Hidden DNA of Amazon, Apple, Facebook and Google

You can view my other book notes, ratings and recommendations on my books page.

Summary

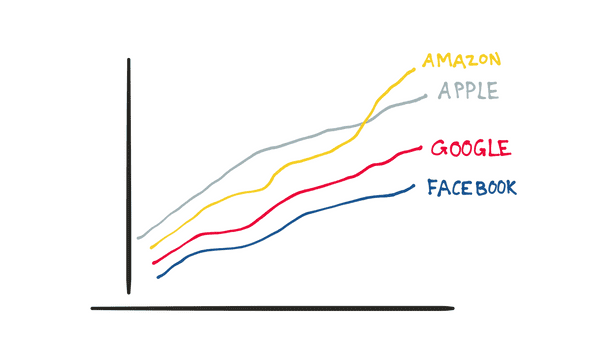

The Four (Amazon, Apple, Google, Facebook) are in a race to be the first trillion dollar company. Between them, they map the world, create thousands of jobs, create a huge amount of stockholder value and build personal supercomputers. But they also avoid tax, leak personal data and make some markets anti-competitive. Large incumbents don’t know how to react to them and smaller startups are often killed or acquired. They only really fear each other and are beginning to compete with each other in a number of ways.

Amazon

Amazon has become one of the biggest brands in the world. 51% of US households have a prime account. But how has it become so popular?

It appeals to our evolutionary human nature to have more stuff

In the past, as hunter-gatherers we would stockpile foods in order to avoid shortage. This made sense then as food could be difficult to come across1. Now our access to goods is much higher but those innate desires remain the same. In a world driven by consumerism, Amazon has thrived as our means to get hold of any product.

Amazon has been able to raise huge amounts of patient capital

Amazon went for years without making a profit. Jeff Bezos has been able to sell a huge vision on the company that is based on future growth rather than current profits.

- Vision - The Earths biggest store.

- Strategy - Lower prices, more selection and faster delivery (all permitted by investor money).

In stock markets, most retail brands trade at 8X revenue multiple but Amazon trades at 40X. This abundance of capital allows them to take risks (e.g. research into floating oceanic warehouses). It also allows Amazon to make expensive investments in areas that provide a moat to competitors (e.g. building large warehouses armed with robotics).

Amazon’s other businesses

Amazon has also been able to use retail (low margin business) to navigate into other more profitable businesses. For example, Amazon AWS provides cloud services and is a huge business in its own right2.

They have also developed retail stores in order to sell phones, tablets and other higher-margin devices. Retail stores are important as part of a multi-channel strategy for products that require customers to touch and feel them. Amazon has had an easier time switching to in-store retail than traditional retailers (e.g. Walmart have had developing online).

Amazon Alexa and the Echo is another example of a product they have been able to create and distribute via Amazon’s main retail arm.

Negative impacts and losses caused by Amazon

- Job loss - Amazon warehouses are armed with robotics that is automating thousands of jobs. Bezos is a supporter of universal basic income, which seems to indicate he believes the net change in jobs of automating will be negative.

- Grocery industry - Amazon has long tried to get into groceries and with the purchase of Whole Foods it is in a far better place to do so.

- Walmart - One of America’s biggest companies will likely struggle to deal with Amazon’s increasingly superior tech and distribution network.

- Google - Customers are beginning to use Amazon directly for product searches, rather than Google.

Apple

Apple has become one of the biggest and most loved brands in the world (and perhaps ever). It’s moved away from its roots as a geek-culture product and is now a modern luxury brand; it signals to others that we are cool, smart and have good taste.

5 traits of a luxury brand

- Iconic founder - Steve Jobs is much loved and hugely referenced founder. He represents a wave of clean, well-designed minimalist products. The fact he died meant the company was also protected from him becoming mediocre in old age.

- Artisanship - Luxury products don’t just function, they delight.

- Vertical integration - Apple owned the whole experience of sale by developing flagship retail stores that became shrines to their products. These stores create brand love which drives up margins.

- Global - In terms of customer base, production and tax avoidance.

- Premium price - By becoming a luxury brand Apple can charge more from products and rely on consumer lack of rational decision making to continue purchasing. They aren’t just buying a phone, but rather a signal to potential mates that they are cool and desirable.

Perhaps Jobs greatest feat was to realise early that Apple’s products would be supported by in-store retail experiences. These have driven huge margin and brand love and now act as huge moats for the business. Whilst brands can build similar products they can’t match the retail experience.

Apple is unique amongst The Four as the only luxury brand.

Facebook reaches 2bn users. Only football reaches more people and it’s done so over many more years.

It is the first platform to reach that scale with a huge knowledge of its users (data).

Science has shown that fostering relationships and community is a factor in creating happiness. So Facebook plays an important role in society in connecting people.

But this also provides it with huge moats, network effects, as the product gets more valuable the more people that are on it. As they add more people they also collect more data.

Zuckerberg has also acquired boldly and aggressively. Buying Instagram for $1bn seemed crazy at the time but it is easily worth 50X that now.

Facebook has become one of the biggest media players (with Google) without incurring and costs of that content (its all user-generated). Could you imagine the value of Disney or Netflix if it has 0 content costs?

Negatives of Facebook

- Facebook has become a home for polarising and radical views (that are often fake news).

- It absolves itself from the responsibility of these views by saying its a platform rather than a media outlet.

- Job loss caused by the shift from old media (newspapers, etc) to new media.

Facebook and Google make up a media duopoly that for the first time do not view themselves as a media outlet. This is interesting given the historic role media has played and an ‘arbiter of truth’ and its potential influence in political powers.

Previously, people turned to religion to seek answers about the world, now they turn to Google. We trust Google as much as any brand; asking it questions we wouldn’t ask our partners. Google has been able to increase profits whilst lowering prices to customers. In terms of market share, it is the most dominant of The Four (and is a clear monopoly).

Additionally, it has created Alphabet to take risky bets whilst it’s advertising business continues to grow.

Potential Google weaknesses

- Its dominance in market share makes it susceptible to regulation.

- It’s other projects contribute very little to its bottom line, meaning it has a lack of revenue/profit diversification.

How Have The Four Managed To Get Ahead?

Steal and borrow

- Steal then protect - The Four have been adept at taking other people’s ideas and turning them into profit-making businesses. The history of innovation has been stealing ideas. America stole ideas from the UK. China stole ideas from America. Apple stole ideas from Xerox. Steve Jobs saw an opportunity that Xerox was not adequately moving on and made it part of a super successful product (the Graphic User Interface display in Apple Computer).

- Just borrowing - The Four also borrow your information/data then turn this into products. Think about all of Google’s free services which contribute to a data profile they sell. Facebook does the same.

The Four and the body

The Four appeal to our human nature through 3 main areas:

- The Brain - Is rational and logical. It looks for the best price, best value and best functioning product. Amazon appeals to the brain as its the easiest and cheapest way to get products. Google appeals to our brain as it makes us smarter and more informed.

- The Heart - Is less rational and makes decisions based on emotions. This means there is still scope for higher margins. Although, brand love and marketing power is beginning to diminish as services popularise search, reviews and comparison. Facebook appeals to our heart as it connects us to friends and cares for our social desires.

- The Genitals - Brands which signal status and desirability can thrive. Apple is a big signaller that we are cool, trendy and desirable.

It’s interesting to note that each of these companies had effective entry points before truly appealing to one of these areas. Facebook grew through university networks before wider appeal. Apple started in niche geek culture before becoming a luxury brand. Amazon says it’s going to supplement UPS (but it almost certainly will crush it). Google was just a small cute search engine before it partnered with huge sites like Yahoo!.

But the cycle of innovation can leave The Four vulnerable as well. Talent begins to move back to startups. Size leads to bureaucracy and slower decisions. They become vulnerable to government intervention.

Traits Of The Four

What are the commonalities of The Four as they race toward trillion dollar valuations?

- Product Differentiation - The Four have differentiated products that leverage technology at multiple steps of the value chain. For example, it may be the experience of buying, the product itself, the fulfilment or distribution, etc. Often removal of frictions is as valuable as adding new stuff in.

- Visionary Capital - They are able to attract capital from public markets with an amazing vision, which enables them to take risky bets that other companies can’t afford.

- Global - In customer base, in product chain, etc.

- Likability - Means less likely to be targeted by regulation.

- Vertical Integration - They own the whole experience, including the distribution of product (via stores if applicable).

- AI/Data - The Four have access to huge amounts of data which they can mine for use in future products, new product categories or to improve existing products.

- Career Accelerant (talent) - These huge brands are hugely attractive on people’s CVs as a signal so they are able to attract great talent.

- Geography (talent) - These big companies have benefitted from being founded or having offices near some of the top technical universities in the world.

The Four satisfy each of these criteria to different degrees but these commonalities are the lines by which new competitors need to compete.

The Fifth?

Which company might emerge to compete with The Four in the race to a trillion dollars?

Alibaba

Huge retailer. Massive home market. Exceptional growth. Uses AI well. But less of an aspirational storyteller and with a weaker brand (than say Amazon). Yet to go into Western markets with any purpose. As a China-based company has some negative connotations of being anti-innovation or of IP theft and so on.

Tesla

Very vertically integrated. Great brand (both green and cool). Visionary leader who can drive huge access to capital. Pre-buying of cars is also a cheap means of getting credit. But the scale is still relatively small (in comparison to The Four) and not yet penetrated global markets in a significant way.

Uber

Global. Acquired lots of capital. Great product. Not vertically integrated. Not that differentiated. Huge potential for regulation. Not very likable.

Walmart

Huge market. Have lots of physical assets that they could turn into distribution hubs. Have capital. Not likable. Not digital-first.

Microsoft

Global. Growth in cloud products, enterprise and via acquisition of LinkedIn. Little access to capital. Not likable. Not a career accelerant as it used to be.

AirBnb

Tempting to say its similar to Uber but its product is far more differentiated. Good access to capital. Likable (company and founder). Has considerable network effects. Not vertically integrated.

IBM

Still a huge tech company and found success in shifting to high margin services. Not a career accelerant. No good access to capital.

Telcos

They control the lines (in being ONline). High margin and huge revenues. Not global. Not career accelerants.

Or someone else?

Facebook has only been around 10 years. It’s possible that another startup could rise up to challenge The Four that isn’t even known yet.

The Four And You (And Your Career)

The rise of The Four has impacted the job market as a whole. What should we consider in this new environment?

The new global market means it better than ever to be exceptional but worse for everyone beneath. The Four will find the exceptional and pay above the odds to get them, but below that becomes tougher. You may only be 10% worse but earn 10x less.

Fundamentals

By and large haven’t changed:

- Grit - ability to work hard

- Empathy - treat people well and understand others

- Excellence - be smart and output driven

Personal Factors

It’s more important than ever to have high emotional intelligence and be emotionally mature. The one constant is change - so being able to ride the waves of change whilst remaining enthusiastic, stable, likable, and so on is key. You need to be flexible and adaptable. You need to be curious. You want to take ownership and obsess about the details.

College

College is still the best signalling system to potential employers. Even if you drop out, the network can be useful. (Granted - it’s not something that everyone can afford. Failing that, get credentials in more niche areas).

Winning habit

You need to become a competitor and learn how to win.

Cities

Even in a world of remote opportunities, wealth still accumulates in the super cities of the world. Be in one.

Personal brand

Learn how to get your good work in front of people and be known for your opinions. Social media is a great tool for this.

Equity

Wealth is accumulated by having equity in things. Go for equity wherever possible and invest in assets3.

Career monogamy

Pick a place for 3-5 years but keep an ear open for interesting conversations. When something is attractive, learn to play companies off of each other.

Be loyal to people, not companies

Keep your boss happy and they will pay you back ten-fold.

Other tips

- Work hard early on - it’s a time when you can get ahead and it compounds.

- Go where your skill is valued - if you’re technical, be in a technical company. If you’re in sales, go to a sales-driven company. Look at the senior managers in your company and see their background.

- Give help

- Be unsexy - great opportunities can often be where other people are not looking. Less competition.

-

Sapiens - Also talks about hunter-gatherers evolutionary desire to gather and hoard food.

↩ -

Amazon's New Customer - This Ben Thompson post does a good job of explaining Amazon's strategy around AWS (and it's acquisition of Whole Foods).

↩ -

Rich Dad, Poor Dad - On the importance of equity (or building assets) in order to accumulate wealth.

↩

You can view my other book notes, ratings and recommendations on my books page.